22025 Standard Tax Deduction For Single - This tax benefit can be claimed regardless of the actual. For the 2025 tax year (for forms you file in 2025), the standard deduction is $13,850 for single filers and married couples filing separately, $27,700 for married couples filing jointly and. Standard Tax Deduction 2025 Indiana Gray Phylys, The standard deduction for single taxpayers will be, $14,600, an increase from $13,850 in 2025. Here you will find federal income tax rates and brackets for tax years 2022, 2025 and 2025.

This tax benefit can be claimed regardless of the actual. For the 2025 tax year (for forms you file in 2025), the standard deduction is $13,850 for single filers and married couples filing separately, $27,700 for married couples filing jointly and.

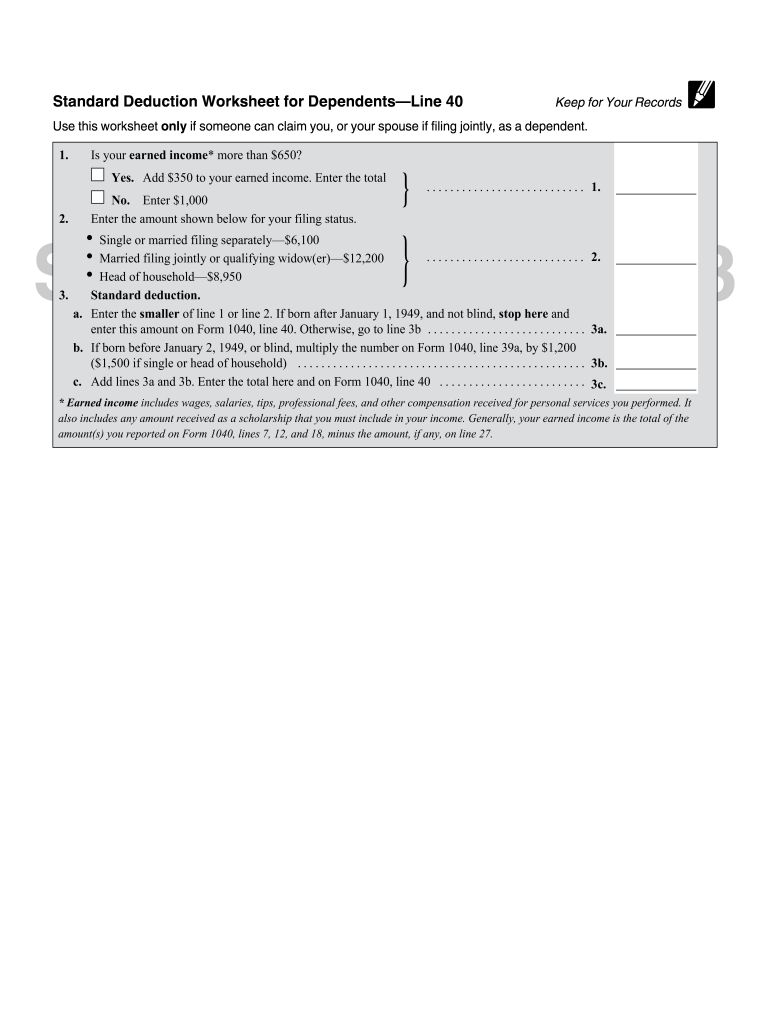

Standard Deduction in Taxes and How It's Calculated, For single taxpayers and married individuals filing separately, the standard deduction rises to $14,600 for 2025, an increase of $750 from 2025; Section 63(c)(2) provides the standard deduction for use in filing individual income tax returns.

Here you will find federal income tax rates and brackets for tax years 2022, 2025 and 2025.

22025 Standard Tax Deduction For Single. Here you will find federal income tax rates and brackets for tax years 2022, 2025 and 2025. The standard deduction amounts will increase to $14,600 for individuals and married couples filing separately, representing an.

Tax Brackets 2025 Single Head Of Household Eartha Renell, For single taxpayers and married individuals filing separately, the standard deduction will rise to $14,600 for 2025, up $750 from this year; People 65 or older may be eligible for a.

2025 Tax Brackets And Tax Rates Freddi Robina, The standard deduction is a fixed deduction of rs. Heads of household will see a $1,100 increase to $21,900 compared to 2025's $20,800.

Standard Federal Tax Deduction For 2025 Cati Mattie, Most of them look for the investment options available under. And for heads of households, the.

Standard deduction 2022 Fill out & sign online DocHub, And the standard deduction for. Section 63(c)(2) provides the standard deduction for use in filing individual income tax returns.

For the 2025 tax year (for forms you file in 2025), the standard deduction is $13,850 for single filers and married couples filing separately, $27,700 for married couples filing jointly and.

IRS Announces 2022 Tax Rates, Standard Deduction…, Calculate your personal tax rate based on your adjusted gross income for the current tax. For the tax year 2025, single filers (people who are not married and do not qualify for any other filing status) are eligible for.

2025 Tax Brackets Single Filer Nikki Analiese, This tax benefit can be claimed regardless of the actual. People 65 or older may be eligible for a.

Irs 2025 Standard Deductions And Tax Brackets Siana Maegan, People 65 or older may be eligible for a. Most of them look for the investment options available under.

2025 New Tax Deductions Jody Rosina, For single taxpayers and married individuals filing separately, the standard deduction will rise to $14,600 for 2025, up $750 from this year; Indian taxation system allows a flat deduction to salaried employees.

For the 2025 tax year (for forms you file in 2025), the standard deduction is $13,850 for single filers and married couples filing separately, $27,700 for married couples filing jointly and.